Key Insights

- Chainlink trades in a tight long-term range as analysts watch for a breakout that could set the next major trend.

- The development of ETF and declining exchange reserves exhibit an increase in interest, but traders are waiting till there is a definite movement above major levels.

- The macro trends indicate that Chainlink is approaching a breakout phase with the increase of DeFi rotation and support monthly.

Chainlink is becoming increasingly popular in the market with its price fluctuating within a thin band that analysts believe may eventually yield to a sharp swing. Chainlink has moved close to a large compression point and chart structures and ETF advancements are taking attention.

Chainlink Long-Term Range Holds as Market Watches Breakout Levels

Chainlink stays within the $13–$26 range on the weekly chart, and analysts say this zone now guides the market view. The structure has formed over several years, and it has produced lower highs and higher lows on the long-term chart. This has left traders waiting for a move that can break the pattern.

Analyst Ali noted that this band has become a no-trade area because price action has failed to confirm direction. Chainlink has touched both sides of the range many times, yet each attempt faded. Market analysts say a weekly close above $26 or below $13 is needed so traders can judge the next trend with more certainty.

Chainlink/TetherUS | Source: Ali_Charts/X

Chainlink sits near the center of this area, so risk and reward inside the band remain limited. Some traders use short swings inside the zone, though they also face the chance of a sudden move if volume expands near the edges. Many analysts now watch for higher trading activity as price approaches the key levels.

Chainlink ETF Progress and Market Data Add to Broader Outlook

Bitwise’s proposed Chainlink ETF has appeared on the DTCC list, and this move has created new interest in the asset’s market position. The listing shows the clearinghouse has prepared back-office steps, and this aligns with standard practice before fund launches. Yet the ETF still needs an effective SEC filing before any trading can begin.

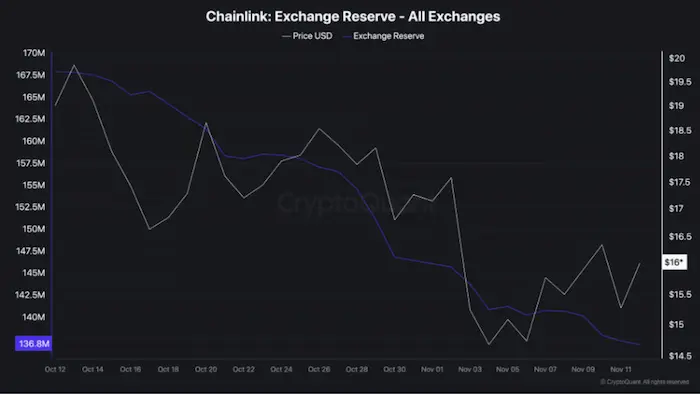

This move has provided traders with additional incentive to monitor Chainlink because it remains within the narrow band. Retail and institutional users who track regulated products can be attracted through ETF development. The listing is also provided when the exchange reserves have decreased in the last month according to the on-chain data.

CryptoQuant data shows that holders moved a large share of tokens away from exchanges during this period. This trend reduces near-term selling pressure, though the price has not formed a strong rally. The market continues to wait for stronger signals before shifting its view.

Chainlink Exchange Reserve | Source: CryptoQuant

Chainlink Exchange Reserve | Source: CryptoQuant

DeFi Rotation Builds as Analysts Track Monthly Structure

Analysts such as woods.ai and James say the broader DeFi market may enter a new rotation phase next year. They point to long-term patterns that show Chainlink building a strong base above the $15 zone. They also note that this area has served as both support and resistance during past cycles.

https://x.com/robw00ds/status/1988272951490388229?s=2

James said the monthly chart looks like a multi-year triangle as price moves toward the upper trendline. A confirmed break above this line could open the path toward the $25–$30 area. Traders also watch the LINK/BTC pair, where resistance near 0.0000439 BTC remains the level to pass.

If Chainlink stays above $15 level, analysts say the market could attempt another move toward $17. Yet a drop below nearby support could return price to the center of the long-term range.