Key Insights

- Dogecoin’s $0.08 level is the strongest support, backed by 27.4 billion DOGE holdings.

- Positive exchange inflows indicate Dogecoin may see a short-term rebound from recent lows.

- Whale accumulation of over 4.7B DOGE adds buying strength near the $0.15–$0.16 range.

Dogecoin has shown volatility over the past week as prices fell to multi-month lows. On-chain data suggests a strong support level exists, attracting attention from traders and investors. Current exchange flows and whale activity could shape the short-term price movement of DOGE.

Dogecoin Cost Basis Reveals Support Levels

Analyst Ali Martinez shared data showing Dogecoin’s cost basis distribution. The CBD tracks where DOGE holders last acquired the asset at different price levels. Large clusters of holders at specific prices can act as support when markets fall.

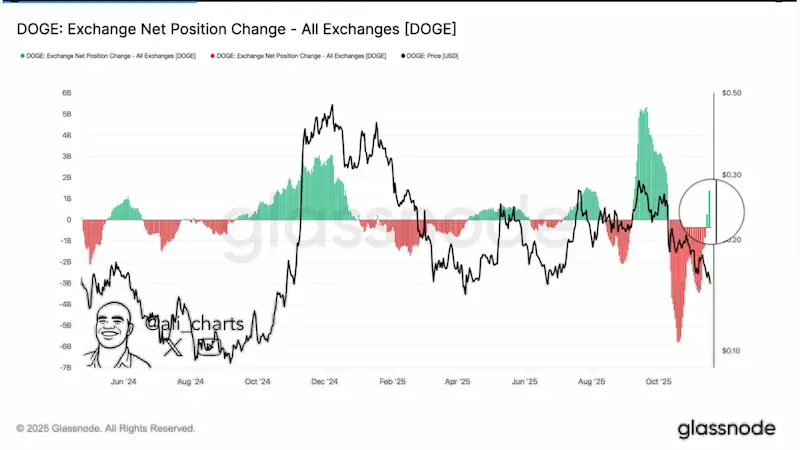

DOGE Exchange Net Position Change | Source: Ali_Charts/X

DOGE Exchange Net Position Change | Source: Ali_Charts/X

Martinez noted that while $0.20 previously held many DOGE holders, prices have dropped below that level. The next major support zone is at $0.08, where approximately 27.4 billion DOGE were acquired

Investors watching the $0.08 level may adjust buying or selling behavior based on price tests. Thin support zones between $0.15 and $0.08 could lead to rapid price shifts if bearish pressure continues.

Dogecoin Exchange Flows Turn Positive

Dogecoin’s exchange net position recently flipped to positive for the first time in months. This metric measures the 30-day change in DOGE held on exchanges. A positive shift indicates more coins are deposited than withdrawn.

Historically, such inflows have preceded short-term rebounds in DOGE. Martinez pointed out that previous positive flips often led to increased buying activity. DOGE currently trades around $0.158, recovering slightly after the recent sell-off.

The shift in exchange supply provides a signal to traders about potential market bottoms. Combined with whale accumulation, it can influence immediate price reactions.

Dogecoin Whale Accumulation and Price Outlook

High-value wallets have accumulated over 4.7 billion DOGE during the recent decline. This buying indicates support from long-term holders against weaker retail flows. Analysts note that these movements can stabilize price near key support zones.

Additionally, Trader Tardigrade highlights that Dogecoin’s exchange net position recently turned positive. This metric measures the 30-day change in DOGE held on exchanges. More deposits than withdrawals indicate potential selling readiness.

https://x.com/TATrader_Alan/status/1991051285437784431/photo/1

Dogecoin’s current resistance is near $0.155, while a successful rebound could lead to levels around $0.18, $0.30, and $0.50. If the $0.150 floor fails, the next support is near $0.08. Analysts are watching price reactions and ETF developments closely to gauge short-term trends.